Feature

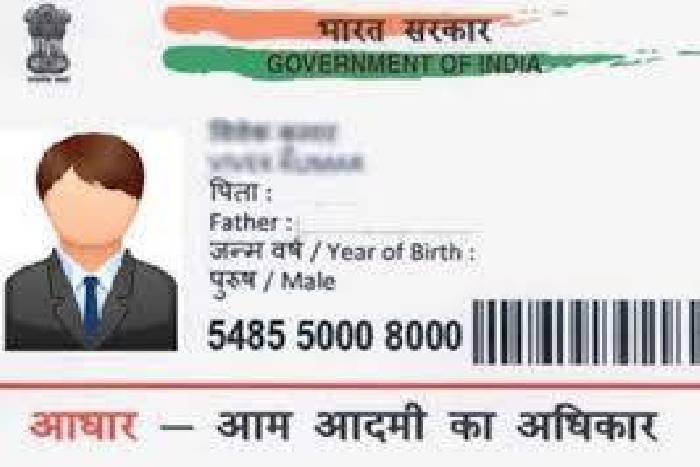

Aadhaar becomes must for all bank accounts: Government

New Delhi: In yet another measure against black money generation, the government has made it mandatory to give Aadhaar number while opening a new account and also to link the existing accounts with the Aadhaar numbers of their holders. Not disclosing it by December 31 will lead to suspension of the account till it is done.

The government move comes close on the heels of the decision last week that all income tax assessees should link their Aadhaar numbers with Permanent Account Numbers (PAN) when they file their returns, after the Supreme Court upheld the law in this regard.

If a customer, eligible to be enrolled for Aadhaar and obtain the PAN, already has a bank account, he needs to submit the Aadhaar number and PAN by December 31, according to a Revenue Department notification.

In case a customer having an account failed to submit his Aadhaar number and PAN by December 31, the account would cease to be operational till the time these numbers are submitted, it said.

The measure had been taken for prevention of money laundering, it added.

“Provided that if the customer does not submit the Permanent Account Number, he shall submit one certified copy of an ‘officially valid document’ containing details of his identity and address, one recent photograph and such other documents, including in respect of the nature of business and financial status of the client as may be required by the reporting entity,” it said.

The Union Budget 2016-17 had mandated seeding of Aadhaar number with PAN to negate the possibility of individuals evading tax using multiple PANs.

The notification-issued by amending the Prevention of Money-laundering (Maintenance of Records) Rules, 2005 — tightened the rules also for small accounts, which can have a maximum deposit of Rs 50,000 and can be opened without having officially valid KYC (Know Your Customer) documents.

According to the notification, such accounts can be opened only at bank branches with core banking solution.

Such accounts can also be opened at branches where it is possible to manually monitor and ensure that foreign remittance are not credited to such accounts and stipulated limits on monthly and annual aggregate of transactions and balance are not breached.

Such small accounts will remain operational initially for 12 months, and thereafter for a similar period if the account holder provides evidence that he or she has applied for officially valid identification documents.

“The small account shall be monitored and when there is a suspicion of money-laundering or financing of terrorism or other high-risk scenarios, the identity of claimant shall be established through the production of official valid documents,” it said.

Post June 1, if a person does not have an Aadhaar number at the time of opening of account, then he or she has to furnish proof of application of enrolment for Aadhaar and submit the Aadhaar number to the bank within six months of opening the bank account.

“In case the client, eligible to be enrolled for Aadhaar and obtain a PAN, does not submit the Aadhaar number or the PAN at the time of commencement of an account-based relationship with a reporting entity, the client shall submit the same within a period of six months from the date of commencement of the account-based relationship,” the notification said.

Entertainment

Meghalaya Reserves Legalized Gambling and Sports Betting for Tourists

The State Scores Extra High on Gaming-Friendly Industry Index

Meghalaya scored 92.85 out of 100 possible points in a Gaming Industry Index and proved to be India’s most gaming-friendly state following its recent profound legislation changes over the field allowing land-based and online gaming, including games of chance, under a licensing regime.

The index by the UK India Business Council (UKIBC) uses a scale of 0 to 100 to measure the level of legalisation on gambling and betting achieved by a state based on the scores over a set of seven different games – lottery, horse racing, betting on sports, poker, rummy, casino and fantasy sports

Starting from February last year, Meghalaya became the third state in India’s northeast to legalise gambling and betting after Sikkim and Nagaland. After consultations with the UKIBC, the state proceeded with the adoption of the Meghalaya Regulation of Gaming Act, 2021 and the nullification of the Meghalaya Prevention of Gambling Act, 1970. Subsequently in December, the Meghalaya Regulation of Gaming Rules, 2021 were notified and came into force.

All for the Tourists

The move to legalise and license various forms of offline and online betting and gambling in Meghalaya is aimed at boosting tourism and creating jobs, and altogether raising taxation revenues for the northeastern state. At the same time, the opportunities to bet and gamble legally will be reserved only for tourists and visitors.

“We came out with a Gaming Act and subsequently framed the Regulation of Gaming Rules, 2021. The government will accordingly issue licenses to operate games of skill and chance, both online and offline,” said James P. K. Sangma, Meghalaya State Law and Taxation Minister speaking in the capital city of Shillong. “But the legalized gambling and gaming will only be for tourists and not residents of Meghalaya,” he continued.

To be allowed to play, tourists and people visiting the state for work or business purposes will have to prove their non-resident status by presenting appropriate documents, in a process similar to a bank KYC (Know Your Customer) procedure.

Meghalaya Reaches Out to a Vast Market

With 140 millions of people in India estimated to bet regularly on sports, and a total of 370 million desi bettors around prominent sporting events, as per data from one of the latest reports by Esse N Videri, Meghalaya is set to reach out and take a piece of a vast market.

Estimates on the financial value of India’s sports betting market, combined across all types of offline channels and online sports and cricket predictions and betting platforms, speak about amounts between $130 and $150 billion (roughly between ₹9.7 and ₹11.5 lakh crore).

Andhra Pradesh, Telangana and Delhi are shown to deliver the highest number of bettors and Meghalaya can count on substantial tourists flow from their betting circles. The sports betting communities of Karnataka, Maharashtra, Uttar Pradesh and Haryana are also not to be underestimated.

Among the sports, cricket is most popular, registering 68 percent of the total bet count analyzed by Esse N Videri. Football takes second position with 11 percent of the bets, followed by betting on FIFA at 7 percent and on eCricket at 5 percent. The last position in the Top 5 of popular sports for betting in India is taken by tennis with 3 percent of the bet count.

Local Citizens will Still have Their Teer Betting

Meghalaya residents will still be permitted to participate in teer betting over arrow-shooting results. Teer is a traditional method of gambling, somewhat similar to a lottery draw, and held under the rules of the Meghalaya Regulation of the Game of Arrow Shooting and the Sale of Teer Tickets Act, 2018.

Teer includes bettors wagering on the number of arrows that reach the target which is placed about 50 meters away from a team of 20 archers positioned in a semicircle.

The archers shoot volleys of arrows at the target for ten minutes, and players place their bets choosing a number between 0 and 99 trying to guess the last two digits of the number of arrows that successfully pierce the target.

If, for example, the number of hits is 256, anyone who has bet on 56 wins an amount eight times bigger than their wager.