Top News

Panama leak shows New Zealand’s ‘shameful’ tax haven status

Wellington :New Zealand is shamefully complicit in international tax avoidance schemes through its lax trust law, experts and lawmakers said on Monday following a massive document leak from a Panamanian law firm.

Wellington :New Zealand is shamefully complicit in international tax avoidance schemes through its lax trust law, experts and lawmakers said on Monday following a massive document leak from a Panamanian law firm.

The papers leaked from law firm Mossack Fonseca, which specialised in providing financial anonymity to the world’s rich, showed a connection to foreign trusts in New Zealand, Xinhua reported.

It was reported that Maltese Energy Minister Konrad Mizzi and the prime minister’s chief of staff, Keith Schembri, were among those who set up trusts in New Zealand.

Massey University taxation specialist Deborah Russell said the leak shed light on New Zealand’s role as an international tax haven.

“It’s shameful for New Zealand to be caught up in international tax avoidance,” Russell said.

“The loophole in our laws that allows New Zealand foreign trusts to escape taxation has been known about for years, but nothing has been done to shut it down. This makes us complicit in schemes to avoid tax.”

She believed it would be comparatively easy to shut the loophole down by authorising the government’s Inland Revenue Department (IRD) to share information about foreign trusts — including the identities of people putting property into trusts — with the tax authorities of other countries.

“This would enable other countries to pursue people who are sheltering property and income in New Zealand foreign trusts,” said Russell.

Opposition lawmakers said the revelations of rich foreigners hiding their wealth in New Zealand had undermined the country’s reputation for honesty and transparency.

The Green Party said the IRD had warned the government in 2013 about the high risks of New Zealand foreign trusts, but the government had ruled out any reform to date.

Green Party finance spokesperson Julie Anne Genter cited an IRD e-mail dated March 24, 2016, that said: “In relation to the foreign trust tax rules, given wider government priorities the government will not be considering regulatory reform of the rules at this stage.”

“How can we as a country work collaboratively with other countries to try and clamp down on tax avoidance by multinational companies while knowingly facilitating tax avoidance through our lax foreign trust laws?” Genter asked in a statement.

Revenue Minister Michael Woodhouse defended New Zealand’s “very sound tax system with world-class tax rules.”

“We tax people who live, work and do business here. We don’t tax foreign income earned by foreigners. The same principles apply to trusts, and have done since 1988,” Woodhouse said in a statement.

“It is ridiculous to suggest that New Zealand is a tax haven, as they thrive on secrecy.”

New Zealand had a strong tax treaty network with the express purpose of discovering and preventing tax avoidance by exchanging information between tax jurisdictions.

The Organisation for Economic Co-operation and Development (OECD) group of developed countries had looked at New Zealand’s foreign trust rules in the past and had no concerns with them, said Woodhouse.

“The tax treatment of foreign trusts may come up in the OECD’s Base Erosion and Profit Shifting work programme in which case we would look at our own rules in the context of everyone else’s,” he said.

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

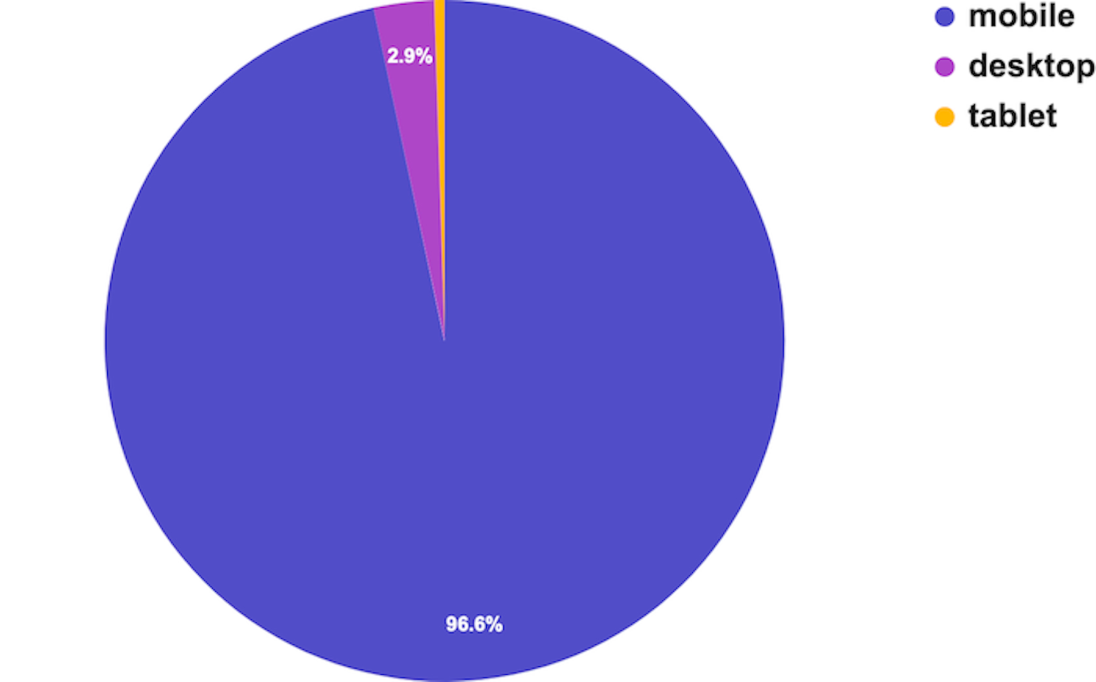

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

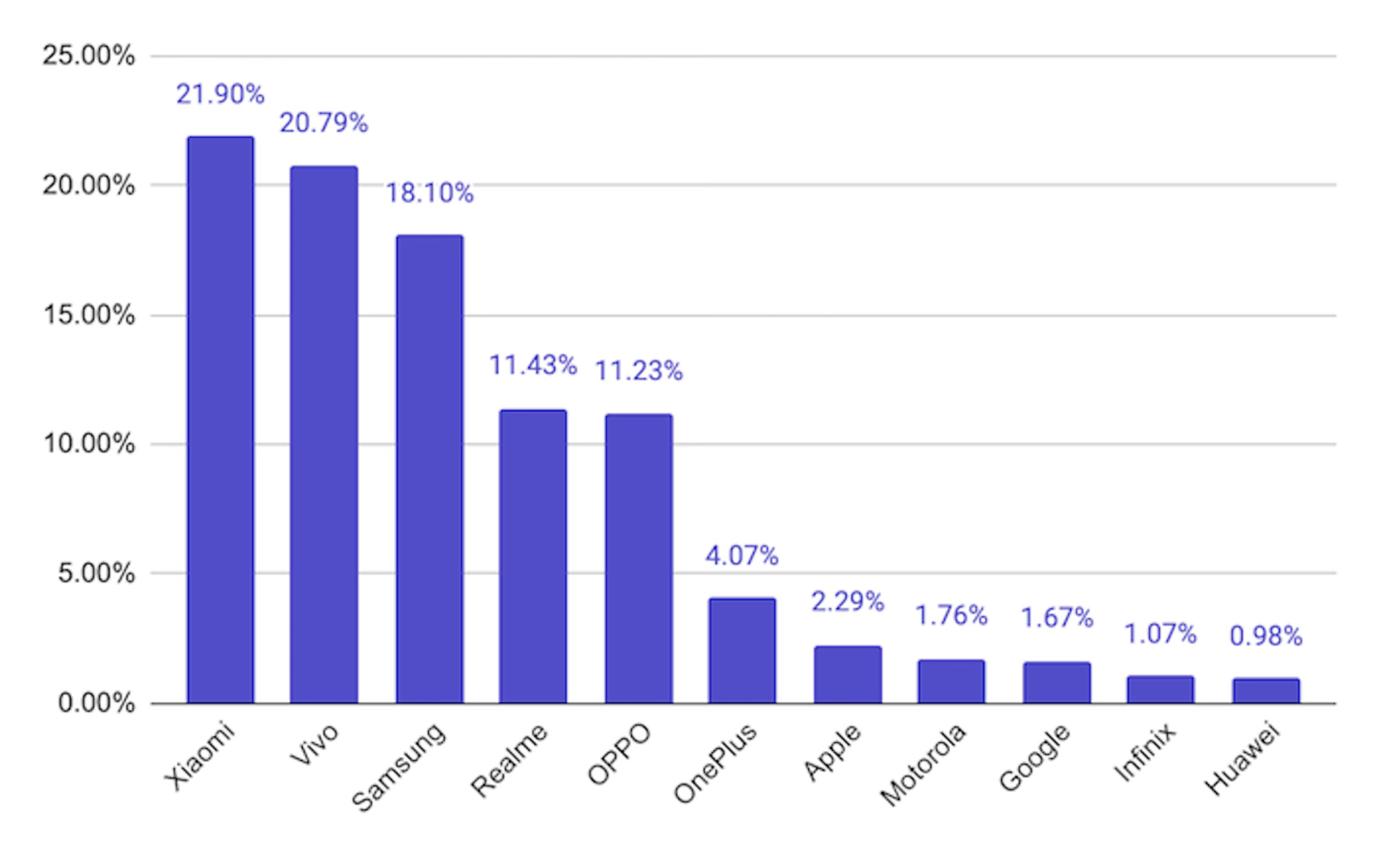

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom