Top News

Union Budget 2016 Update: Government turning taxpayer friendly

New Delhi: Terming tax disputes as a scourge of tax-friendly regime, Finance Minister Arun Jaitley, presenting the budget for 2016-17 on Monday, unveiled a new dispute resolution mechanism to minimise litigation.

He also said that Income Tax officials will be responsible for higher interest payout if there was a delay in implementing the orders of Appellate authority.

He said there were around 300,000 tax cases pending with the First Appellate Authority involving a tax dispute of around Rs.550,000 crore.

As per the new dispute resolution mechanism unveiled by Jaitley, a tax payer who has an appeal pending as of Friday before the Commissioner (Appeals) can settle his case by paying the disputed tax and interest up to the date of assessment.

There will be no penalty in respect of income tax cases with a disputed tax up to Rs.10 lakh.

Accoriding to Jaitley, the cases with disputed tax exceeding Rs.10 lakh will be subjected to only 25 percent of the minimum of the imposable penalty for both direct and indirect taxes.

He said any pending appeal against a penalty order can also be settled by paying 25 percent of the minimum of the imposable penalty.

However, certain categories of persons including those charged with criminal offences under specific Acts are proposed to be barred from this scheme.

With special reference to the government’s assurance of not to create retrospectively fresh tax liability, Jaitley reiterated the government’s commitment to provide a stable and predictable taxation regime and not create fresh tax liability retrospectively.

He proposed one-time scheme of dispute resolution for past cases ongoing under retrospective amendment.

One can settle the case by paying only the tax arrears in which case liability of the interest and penalty shall be waived. This is subject to agreeing to withdraw any pending case lying in any Court or Tribunal or any proceeding for arbitration, mediation under Bilateral Investment Protection and Promotion Agreements (BIPA).

Identifying that levy of heavy penalty as a cause for a large number of disputes, Jaitley proposed to modify the scheme of penalty by providing different categories of misdemeanour with graded penalty and thereby substantially reducing the discretionary power of the tax officers.

The penalty rates will now be 50 percent of tax in case of underreporting of income and 200 percent of the tax where there is misreporting of facts. Remission of penalty is also proposed where taxes are paid and appeal is not filed.

Quantification of disallowance of expenditure relatable to exempt income in terms of Section 14A of the Income Tax Act is another issue led to number of disputes. Hence, it has been proposed to rationalize formula in Rule 8D governing such quantification.

Jaitley said the Income Tax department was also issuing instruction making it mandatory for the assessing officer to grant stay of demand once the assessee pays 15 percent of the disputed demand while the appeal is pending before Commissioner of Income Tax (Appeals).

Jaitley also said the government has accepted many of the recommendations of Justice Easwar Committee.

To make the Income Tax officials responsible, Jaitley said the government will pay nine percent interest on where there is a delay in implementing the Appellate orders beyond 90 days.

“The officers who delay it will be accountable for this loss to the government,” Jaitley said.

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

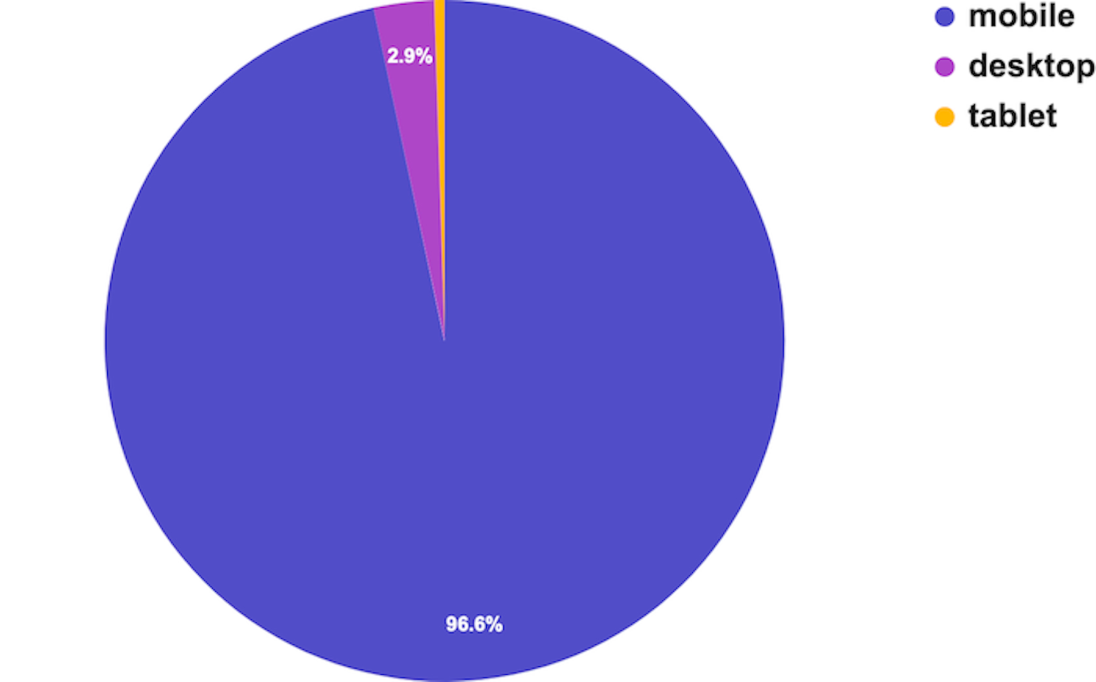

Desktops and Tablets Lose the Battle vs Mobile

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

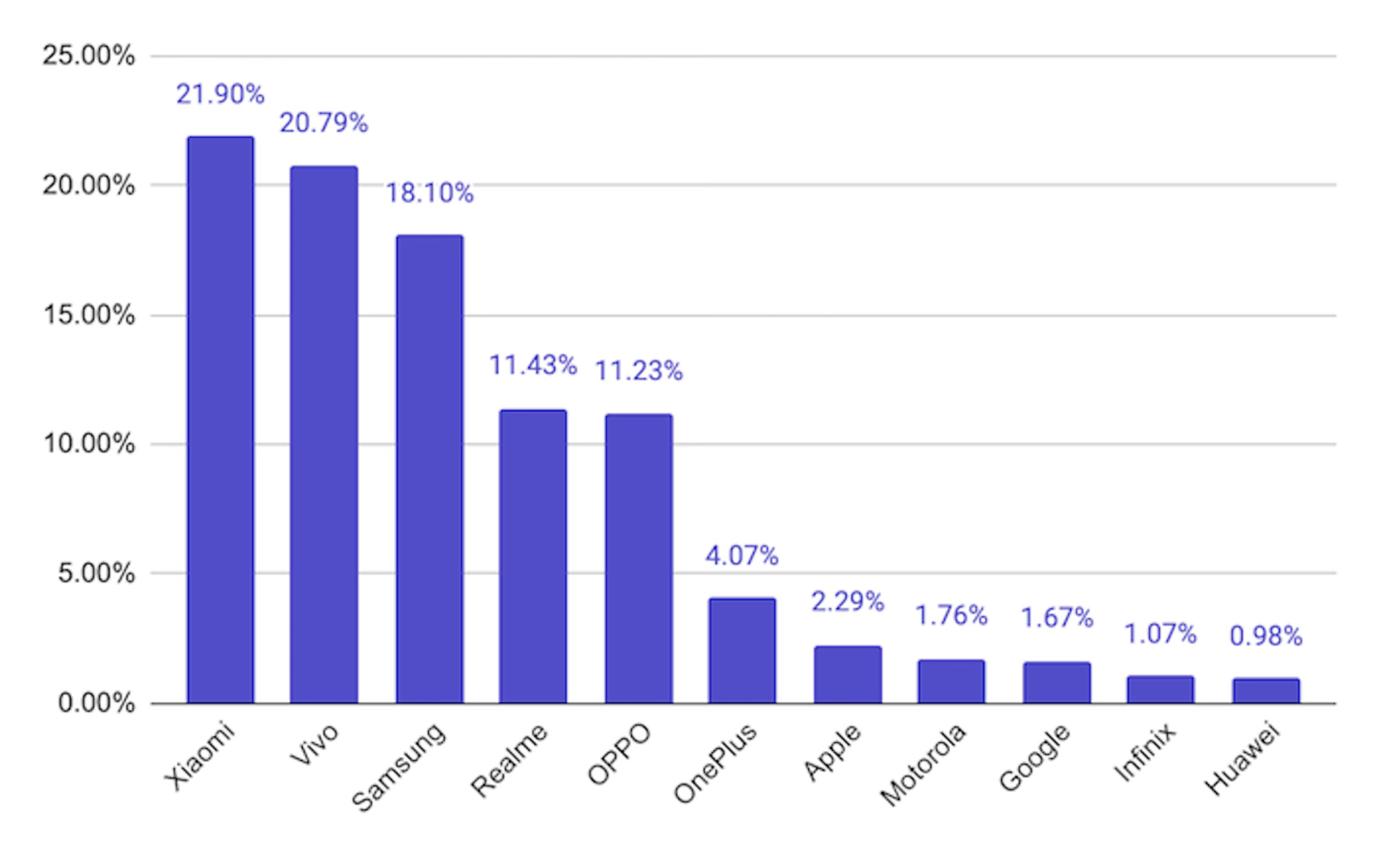

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom