Top News

Government trying to destroy autonomous structure of RBI: Congress

New Delhi, Oct 30 (IANS) Sharpening its attack on Finance Minister Arun Jaitley, the Congress on Tuesday accused the government of trying to destroy autonomous institutions like the Reserve Bank of India and alleged him of interfering in the work of the central bank.

“I have been surprised today by the sharp attack of the Finance Minister on the RBI and its performance. The central bank is independent and autonomous,” Congress leader Anand Sharma told reporters here.

He said that it was in the interest of India and the economy that the RBI alone remains the regulator for the banks for the lending, borrowings and fixes the rates for the banks.

“Only the RBI must have the powers to regulate the public sector banks and none else. This government has ignited a fire through its repeated interference from day one. And now government move to take charge of the monetary policy is a very ominous move,” he said.

“It (attack on RBI) cannot be accepted. It must be opposed. Government being the spending authority, cannot become the monetary authority for the country. Equally important is to remember the role of the RBI as the payment regulator cannot be diluted or taken away by a government nominated body,” the Congress leader said.

His remarks came soon after Jaitley on Tuesday held the central bank responsible for the mountain of bad loans, saying the RBI looked the other way when banks lent indiscriminately during 2008-14 to keep the economy humming.

“Under Modi and BJP, they are damaging all the independent institutions of the country which have their role in maintaining governance and administration like CBI, ED, IT, DRI, Central Universities and many others,” he said.

“I want to make one thing very clear today to Jaitley, since he specifically commented from the year 2008. Very eminent Governors of the RBI, far more competent than Jaitley or Prime Minister Narendra Modi, were there. And that time also the country had the benefit of an eminent economist of unimpeachable integrity in Manmohan Singh as country PM,” he said, adding 2008 was the year when the big financial crisis enveloped the global economy.

“The RBI played a stellar role. It ringfenced the Indian economy and the big economies across the globe took note of the functioning of the RBI,” he said. Even in other big countries their central banks could not effectively ringfence their economy as the RBI did in India,” Sharma said.

Criticising Jaitley for insulting the RBI, he said, “Today Jaitley saying that the RBI is not competent, not capable, is the most unfortunate thing. I demand Jaitley to take his words back and apologise for insulting RBI.”

He said that it was not the first time that the government tried to interfere in the work of the RBI. “The first example the entire world saw was on November 8, 2016 (demonetisation) when 85 per cent currency was invalidated by the Prime Minister,” he said.

“That was the first biggest attack on RBI when it was forced in a board room to take that step,” he alleged.

The Congress leader described Modi and Jaitley as incapable leaders and said, “they have damaged the economy. They have no thinking, and they have wrong policies and wrong direction.”

Slamming the government over the depreciating value of the Rupee, Sharma said, “On the one hand they say that we have the fastest growing GDP and economy and on the other hand there is no investment in the economy, industries shutting down and no employment generation and the rupee value depreciating.

He said that the Indian rupee has lost 16 per cent since January 2018. “And the Prime Minister is busy talking about all matters which are irrelevant and not paying attention to what he and his Finance Minister have proved to be not only inefficient but thoroughly incompetent when it comes to managing of the economy, which has been nose diving.”

“What explanation they have, fastest economy there is a grave contradiction and the worst performing currency in Asia.

“Therefore we demand from this government to desist from destroying another autonomous institution, to retrace their steps and engage in dialogue and consultations rather than seeking to justify what is wrong and unjustified,” Sharma added.

–IANS

aks/vsc/bg

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

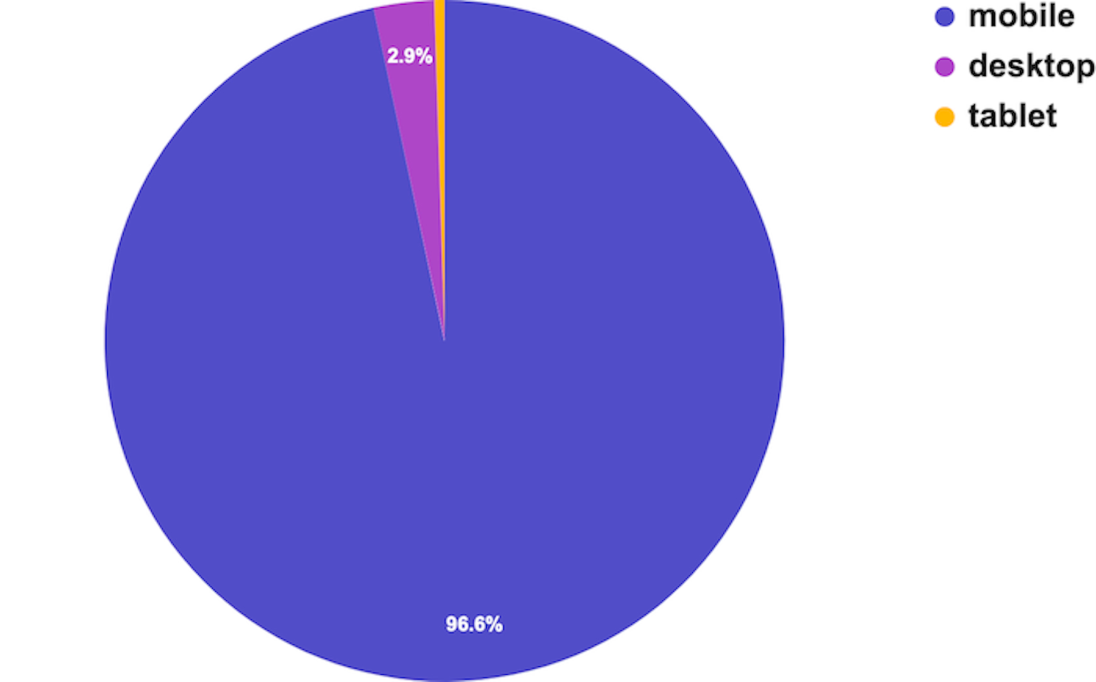

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

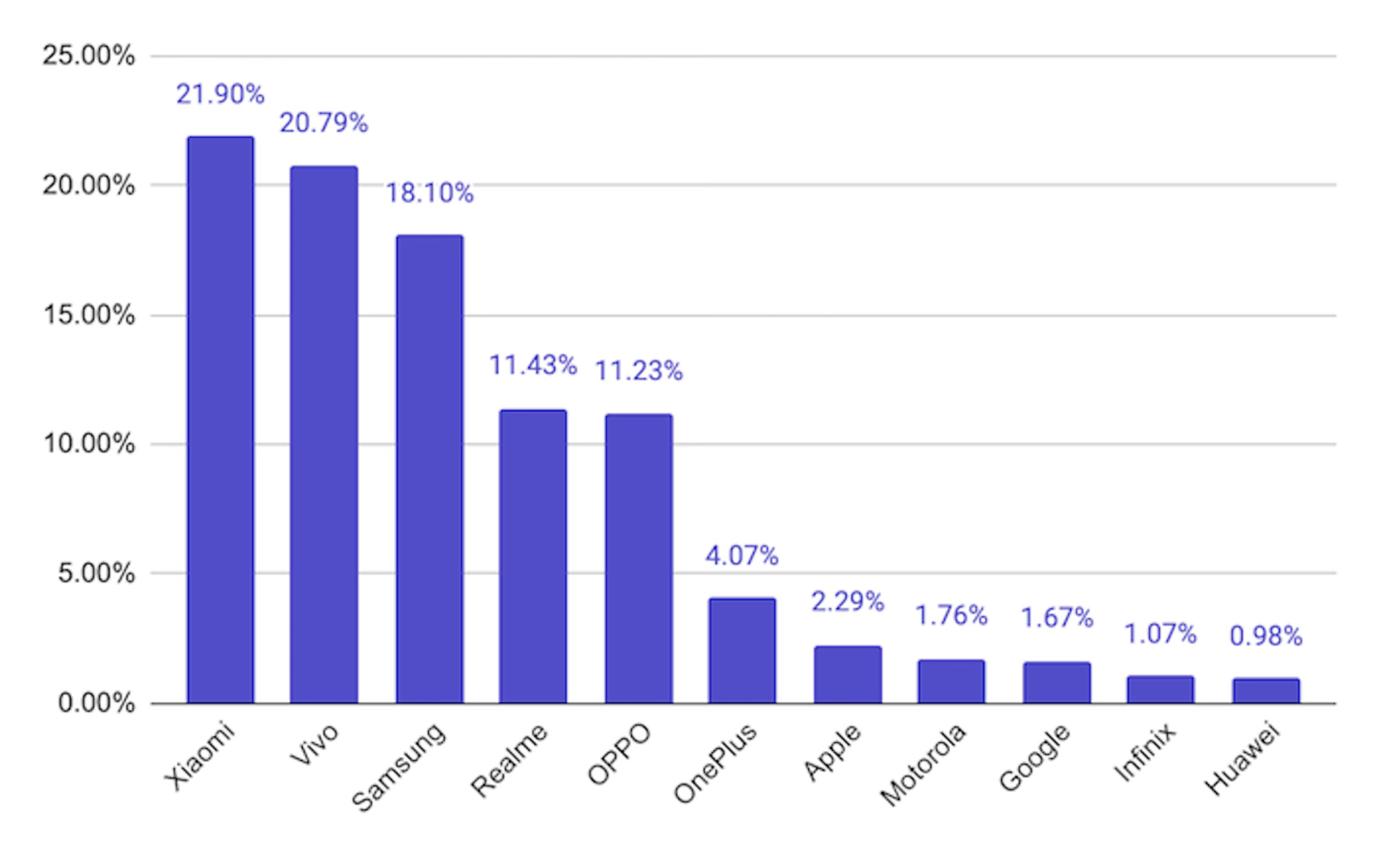

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom