Top News

‘Choksi diverted Rs 3,257 crore to foreign dummy companies’

By Anand Singh

New Delhi, Sep 11 (IANS) Fugitive diamnond jeweller Mehul Choksi, wanted in the Rs 13,500-crore Punjab National Bank (PNB) fraud case, diverted over Rs 3,257 crore of the money raised from fraudently obtained letters of undertaking (LOUs) and foreign letters of credit (FLCs) to overseas dummy firms, an informed source said on Tuesday.

The Enforcement Directorate (ED) source revealed that Choksi of the Gitanjali Group, who acquired the Antiguan citizenship, also highly inflated the prices of precious metals sold from his business outlets and diverted about $106 million to his nephew Nirav Modi and his father Deepak Modi.

The ED source, requesting for anonymity, told IANS: “Over Rs 3,250 crore was diverted and deposited in the Gitanjali Group firms in the US, United Arab Emirates, Thailand, the United Kingdom, Hong Kong, Japan, Italy and Belgium.”

Earlier on Tuesday, Choksi in his first message from his hideout in Antigua denied allegations of wrongdoing and instead accused the ED of “illegally” attaching his properties.

In the video message, the fugitive diamantaire said that his Indian passport was suspended without giving him any opportunity to explain. A Red Corner Notice (RCN) against Choksi is pending with the Interpol.

The ED in its charge sheet against Choksi had alleged that from 2015 onwards a part of the funds was used for repayment of dues of various banks. On scrutiny of the bank account details of the said Indian entities, it was found that huge amounts of debits have been allegedly made from the accounts of these entities maintained with the PNB to the overseas companies of the Gitanjali Group.

“During investigation, it was revealed that transfer of funds was made to the 4Cs Diamonds Distributors, Crown Aim Ltd, Shangyang Gong Si Ltd, Taipingyang Trading Ltd, Abecryst (Thailand) Ltd, and Asian Diamond and Jewellery FZE from the accounts of the Indian entities.

The source revealed that the Gitanjali Group owner also involved Nirav Modi, who is also wanted in the case by the Indian investigation agencies, using several dummy companies to rotate funds.

The source said that Choksi diverted $56.12 million of loan money to his nephew and about $50 million to Nirav Modi’s father Deepak Modi.

In its charge sheet, the financial probe agency alleged that Choksi used several dummy companies for rotating his transactions.

“Under this arrangement, the origin of sale transactions and final destination used to be any of the Gitanjali Group of companies. And for in-between transactions, dummy companies were used for layering purpose wherein only sale or purchase bills were created and no movement of goods took place. Choksi has been doing this to project inflated turnover to avail higher banking facility,” the charge sheet said.

The ED claimed that Choksi used to fix the value of goods without applying economic rationale. “The goods in question were either of low value or poor quality and were not commensurate with the price or value fixed by him,” the ED said.

The charge sheet alleged that these goings on were confirmed by Gitanjali Group’s Vice President Vipul Chitalia in his statement to the agency under the Prevention of Money Laundering Act.

The agency said that the proceeds of crime of money laundering were partly remitted back to the Gitanjali Group of companies in India in the guise of export-import transactions for settling earlier credit liabilities.

Choksi and Nirav Modi are under probe by both the CBI and ED. The ED had on May 24 and 26 filed the charge sheets against both. The court took cognisance and issued non-bailable warrants against them.

Nirav Modi left India along with his family in the first week of January, weeks before the scam was reported to the CBI. His wife Ami, a US citizen, left on January 6 and Choksi on January 4.

(Anand Singh can be contacted at anand.s@ians.in)

–IANS

aks/tsb/sed

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

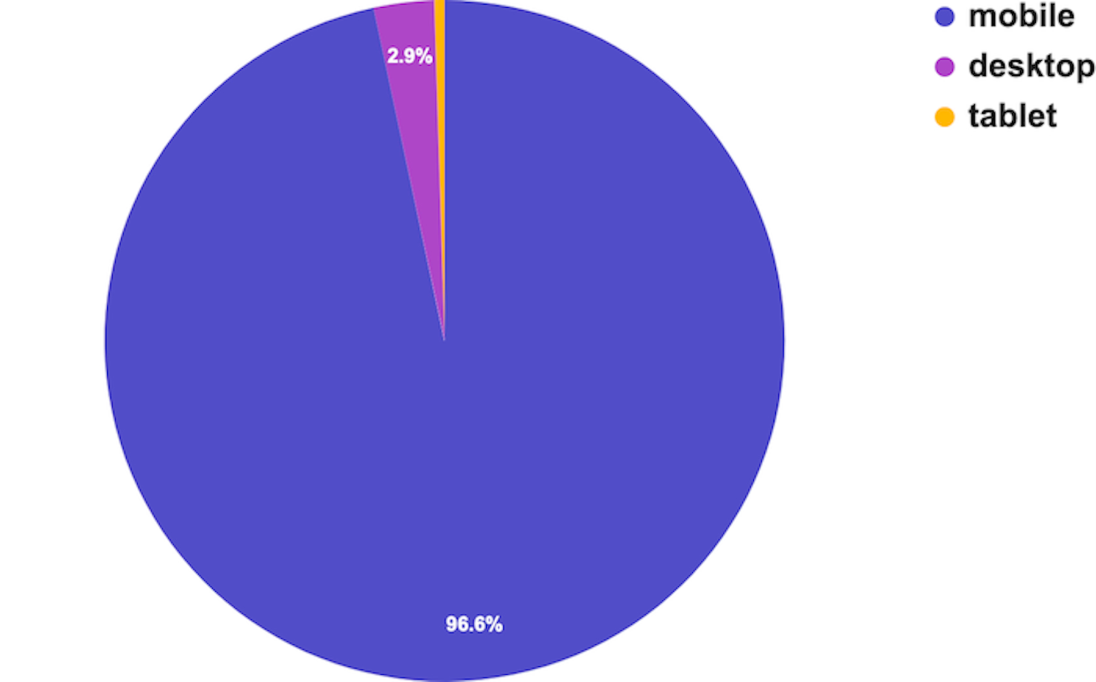

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

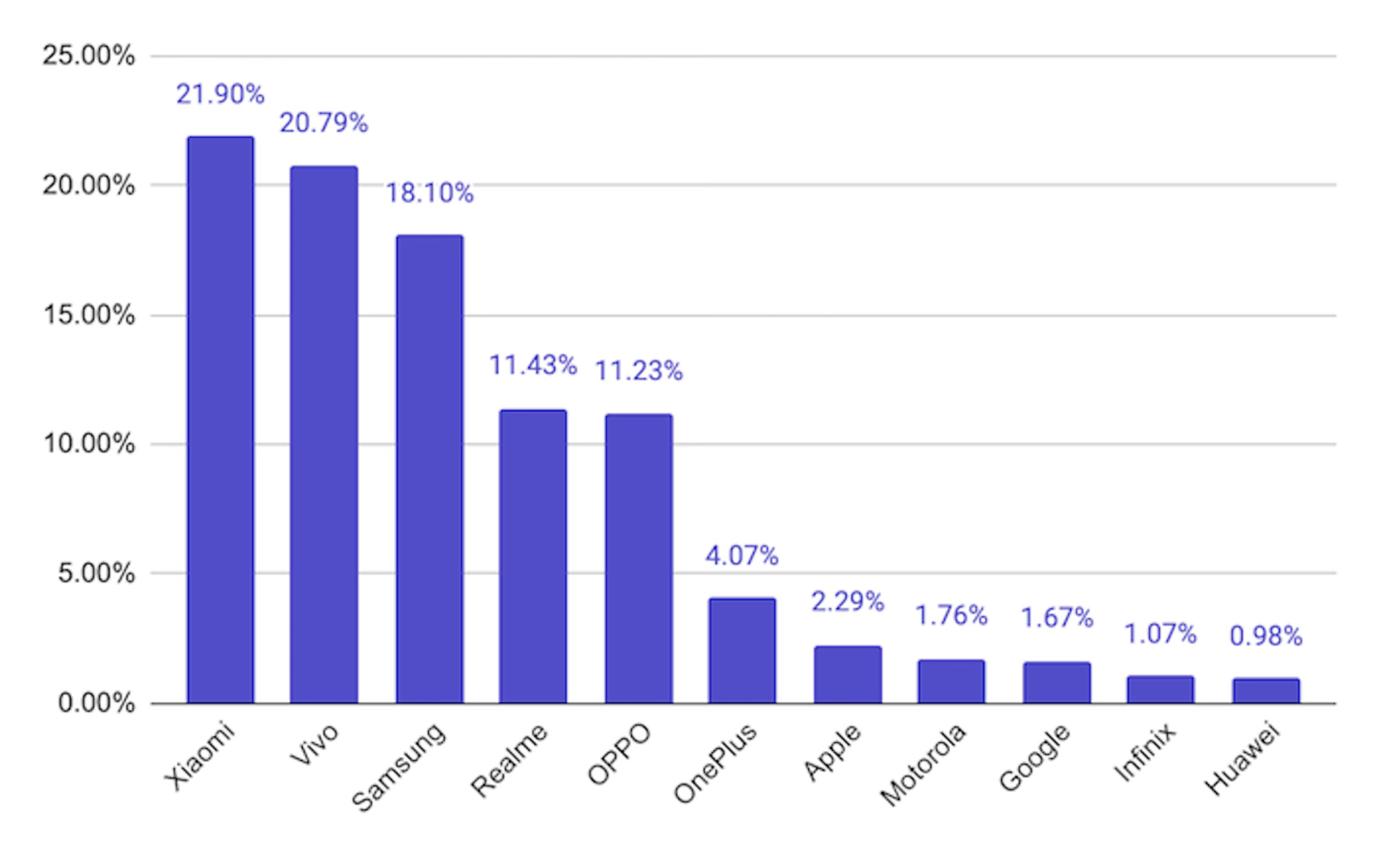

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom