Top News

Value buying breaks equity indices’ six-day losing streak (Roundup)

Mumbai, Sep 6 (IANS) A last hour spurt of value buying aided the key Indian equity indices to snap a six-day losing streak during a largely volatile trade session on Thursday.

According to market observers, a healthy pick-up in healthcare, oil and gas and banking stocks also lifted investors’ sentiments.

Earlier in the day’s trade, the downward spiral in the Indian rupee’s value against the US dollar had subdued both the key indices. The Indian currency had breached the 72 per dollar mark for the first time.

Index-wise, the Nifty50 on the National Stock Exchange closed at 11,536.90 points, higher by 59.95 points or 0.52 per cent from its previous close of 11,476.95 points.

The benchmark S&P BSE Sensex, which had opened at 38,161.85 points, closed at 38,242.81 points, higher by 224.50 points or 0.59 per cent from the previous close of 38,018.31 points.

It touched an intra-day high of 38,320.96 points and a low of 37,912.50 points.

“Markets bounced back on Thursday… The recovery was led by buying in the last one hour of trade and seems to have come on the back of value buying by investors,” said Deepak Jasani, Head of Retail Research at HDFC Securities.

“Broad market indices like the BSE Mid Cap and Small Cap indices gained less, thereby underperforming the main indices. Market breadth was positive on the BSE/NSE.

“Major Asian markets have closed on a negative note barring the Jakarta index. European indices like DAX and CAC 40 are trading in the green.”

Geojit Financial Services’ Head of Research Vinod Nair said: “After six consecutive days of fall on account of global trade tensions and weakening currencies, market showed a recovery today helped by rally in index heavy weights.”

“However, caution prevails in the market due to weakening rupee which touched a fresh low of 72 today against USD, high crude levels and escalating US-China trade tensions which may cause a slowdown in inflow to emerging markets. Pharma outperformed due to rupee depreciation.”

On the currency front, the Indian rupee settled at a record closing low of 71.99 against the US dollar, weaker by 24 paise than its previous close of 71.75 per greenback.

Investment-wise, provisional data with exchanges showed that foreign institutional investors sold scrips worth Rs 455 crore and domestic institutional investors bought stocks worth Rs 611.98 crore.

Sector-wise, only the S&P BSE healthcare index gained 347.81 points, followed by oil and gas index which rose 168.24 points and the banking index that edged-higher by 111.85 points.

In contrast, the S&P BSE consumer durables index declined by 26.60 points, the consumer discretionary goods and services index fell by 6.38 and Teck (technology, entertainment and media) index ended 6.05 points lower than its previous close.

The top gainers at the Sensex were Reliance Industries up 2.80 per cent at Rs 1,260.15; Power Grid up 2.21 per cent at Rs 199.20; Coal India, up 2.05 per cent at Rs 283.20; Sun Pharma, up 2 per cent at Rs 676.65; and Kotak Bank, up 1.76 per cent at Rs 1,260.35.

The majors losers were Yes Bank, down 1.42 per cent at Rs 339; Maruti Suzuki, down 1.33 per cent at Rs 8,772.30; ICICI Bank, down 0.45 per cent at Rs 328.45; Infosys down 0.25 per cent at Rs 727.95 per share and Asian Paints, down 0.20 per cent at 1,314.65.

–IANS

ravi-rv/sed

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

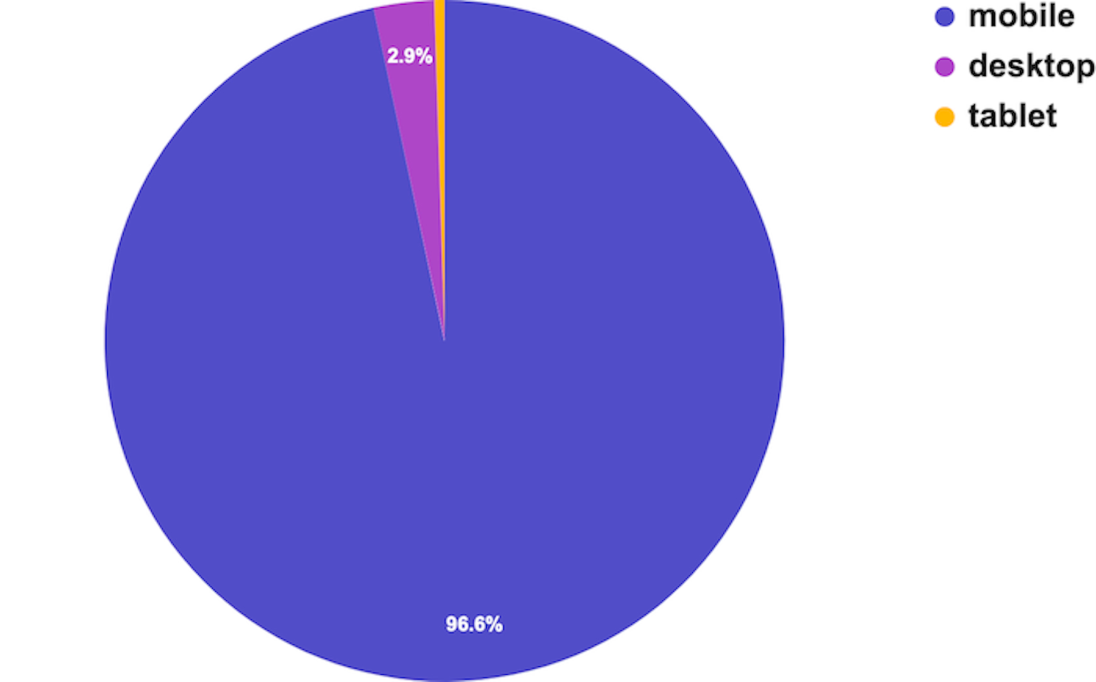

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

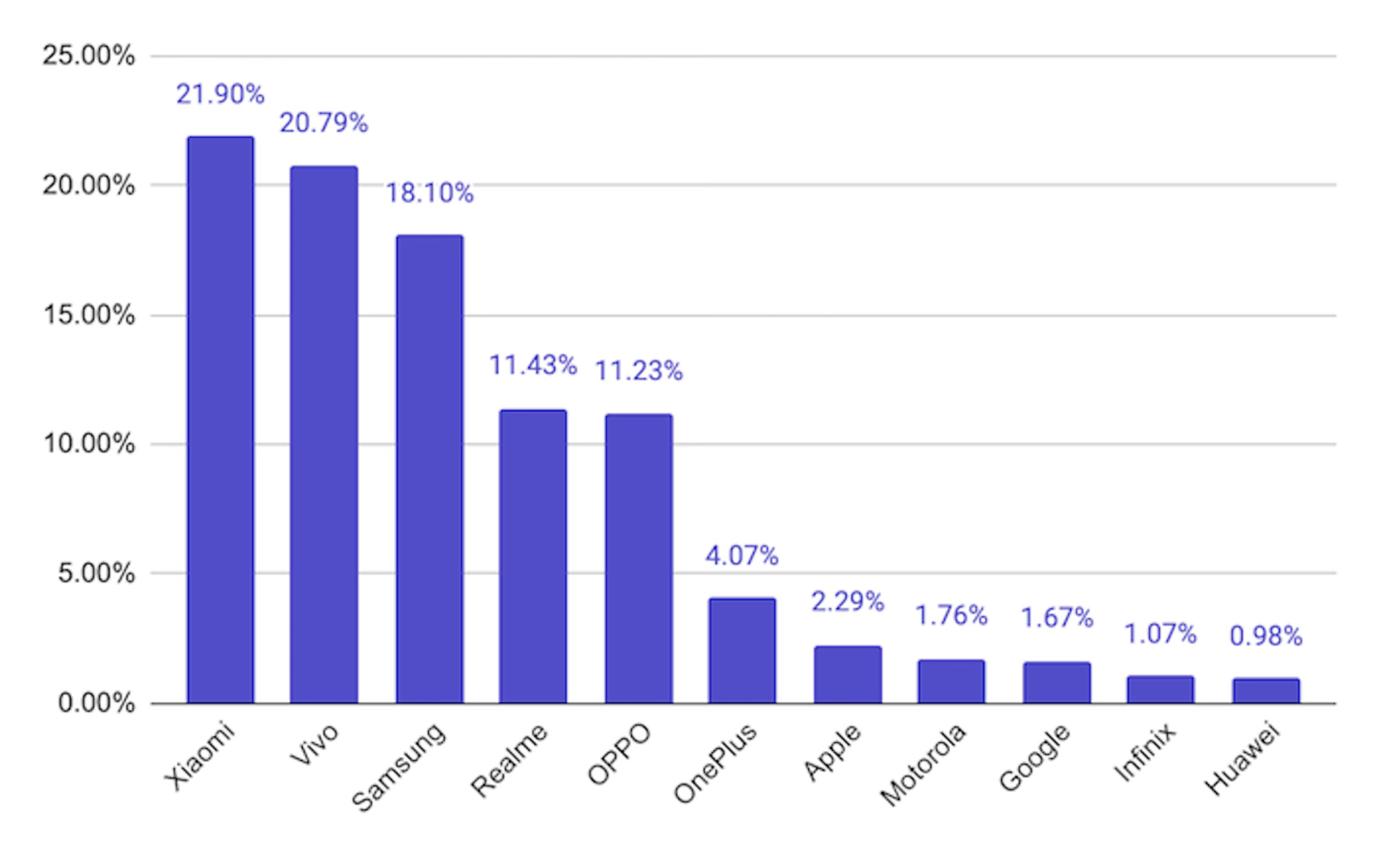

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom