Top News

India wants AIIB investments in 9 projects: Goyal (Lead)

Mumbai, June 25 (IANS) Terming India “a sweet spot where the rule of law prevails”, Finance Minister Piyush Goyal said here on Monday the country wants investments in nine projects from the China-based Asian Infrastructure Investment Bank (AIIB).

Speaking to the media, Goyal said India has already picked up alsmost 28 per cent – or $1.4 billion – AIIB’s total lendings, for seven projects in the country.

The focus of AIIB’s lending has been on rural infrastructure, energy and power, environmental protection, transportation and telecommunication, water supply and sanitation, besides urban developments and logistics.

Goyal said “it’s a matter of great pride that India is the largest recipient of the $4.2 billion funds disbursed by AIIB.”

He attributed a robust framework and easy to navigate policies being the key reasons for the investment flow into the country’s infrastructure sector.

The minister mentioned how Mumbai has improved its ranking in the Swachhta Index significantly during the past few years and is engaging with international global efforts for a better quality of life.

He assured that by 2022, as part of the Prime Minister’s plan, the government will ensure every citizen has a shelter over his head, round-the-clock electricity, good toilets, clean drinking water, access by road to his house and internet connectivity.

Earlier, welcoming delegates from 86-AIIB member countries, Goyal said that in just three years, India has hosted three major international multilateral banks – the New Development Bank, the African Development Bank and now the AIIB.

He lauded AIIB’s robust processes and said how the concept was floated in 2014, matured in barely seven months and the Multilateral Development Bank was in place by 2016, with India as the second largest stakeholder with eight percent.

Later this afternoon, AIIB announced an equity investment of $100 million in India’s National Investment & Infrastructure Fund (NIIF) to help various development projects in this country.

The amount will be for the Phase I of NIIF’s Fund of Fund (Eds: Correct) initial closing and the AIIB is considering another $100 million in Phase II for the final closing, bringing the bank’s total commitment to $200 million.

The NIIF is a collaborative investment platform for international and domestic investors keen on investing in commercially viable Indian infrastructure projects.

The NIIF’s Fund of Fund will anchor or invest in funds managed by fund managers with good track record in various infrastructure and associated sectors in India.

Some of the focus sectors include: Green Infrastructure, Mid-Income and Affordable Housing, Infrastructure Services and Allied Sectors, the AIIB said.

The NIIF Fund of Funds recently announced its first investment – Green Growth Equity Fund – which will invest in renewable energies, clean transportation, water, sanitation and waste management.

The AIIB will provide its expertise to enhance NIIF’s environmental and social risk management capabilities to improve and monitor ecological and social performance across the portfolio investments.

“Our investment in the NIIF reflects AIIB’s commitment to support the Government of India in its efforts to promote investment in infrastructure and to mobilize private capital for development,” said AIIB Vice-President and Chief Investment Officer D.J. Pandian.

The AIIB Director-General of Investment Operations, Dong-Ik Lee, said the NIIF will provide access to a diversified range of sub-funds and trigger a multiplier effect in attracting capital.

“With AIIB’s investment in the NIIF, we will help pool commitments from long-term investors such as multilateral institutions, sovereign wealth funds, pension funds and insurance companiesa”within and outside Indiaa”to make investments in the country’s infrastructure sector,” Lee said.

With a total project portfolio of $4.4 billion, India is the largest borrower from the AIIB since it started its operations two-and-a-half-years ago.

The 3rd AIIB annual meeting was opened in Mumbai on Monday with a focus on infrastructure, coupled with the theme of innovation and collaboration.

–IANS

qn/vm

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

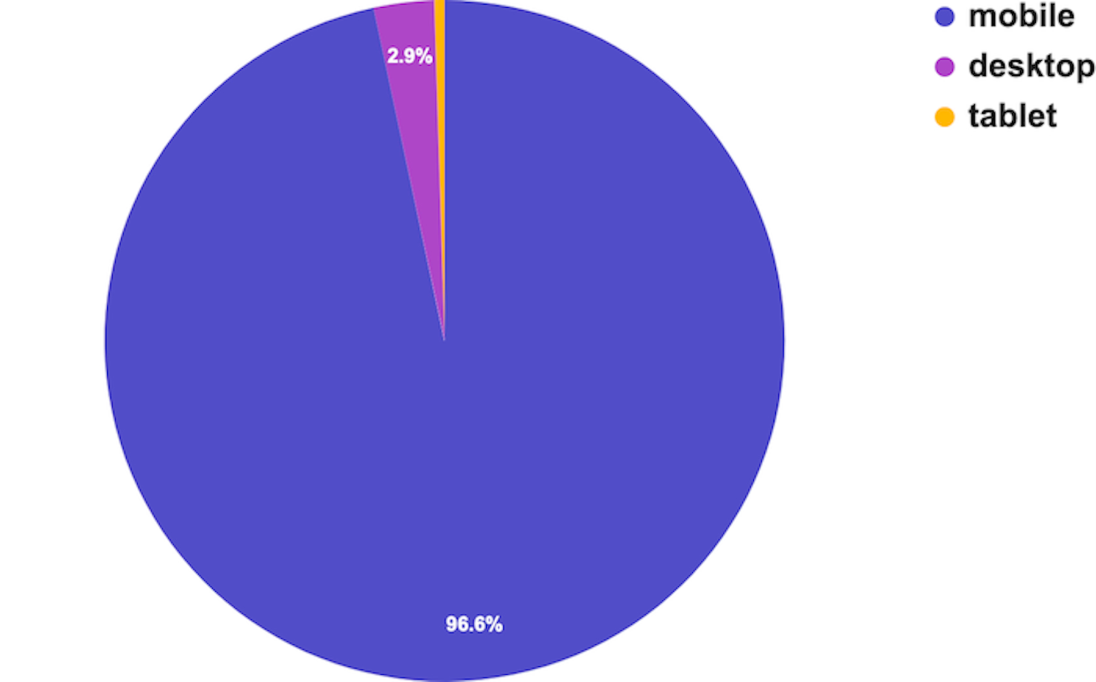

Desktops and Tablets Lose the Battle vs Mobile

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

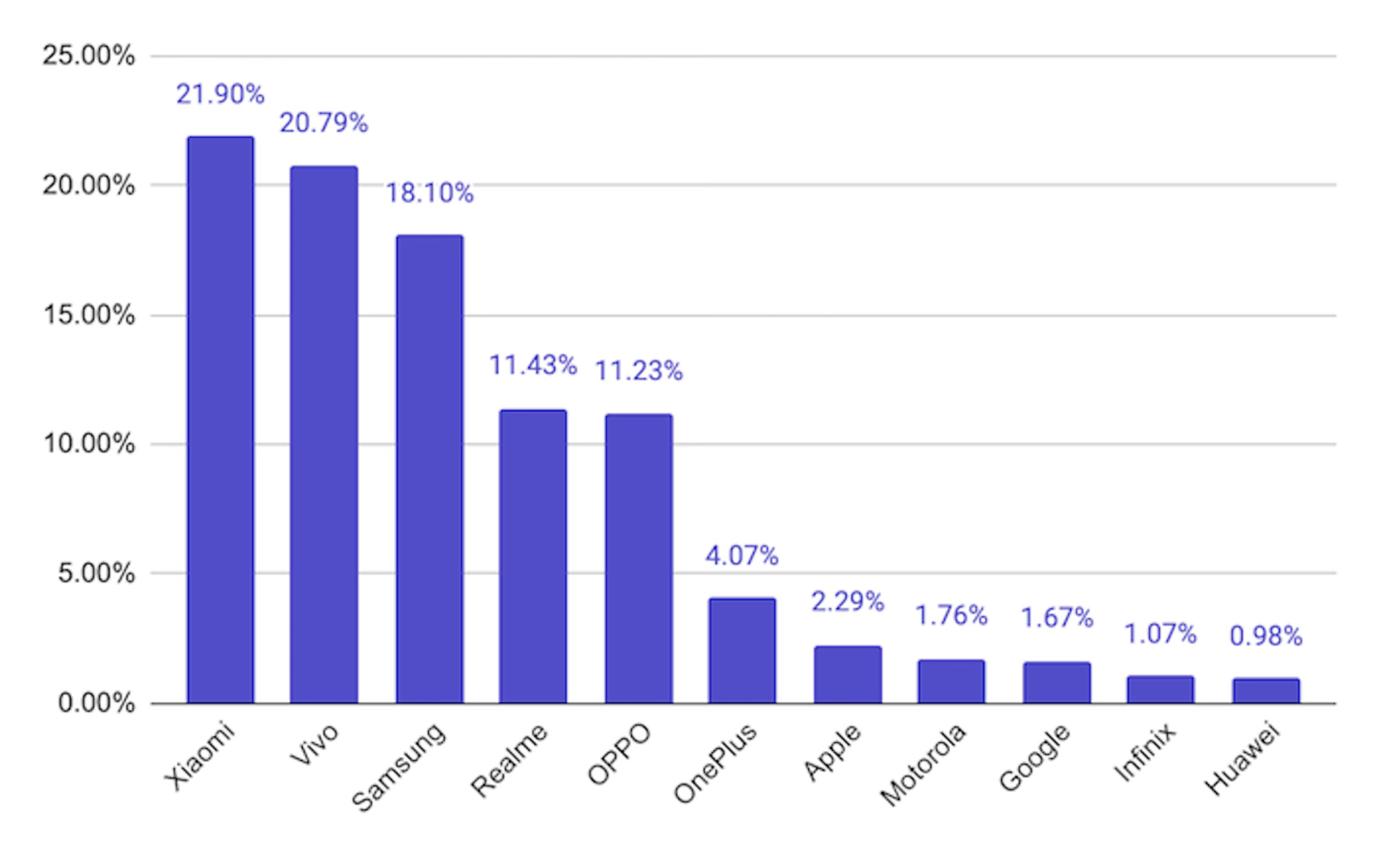

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom