Top News

Quarterly results to influence equity market’s movement (Market Outlook)

By Rohit Vaid

Mumbai, Jan 14 (IANS) The ongoing earnings result season, along with macro-economic inflation and trade data points, are expected to influence the Indian equity market next week.

Market observers opined that global crude oil prices and the rupee’s movement against the US dollar will act as other major triggers.

“Markets next week will continue to focus on earnings of corporates such as Zee, Bharti, Adani, Wipro, MindTree, etc. Earning results, so far, have been in line with expectations,” Devendra Nevgi, Founder and Principal Partner, Delta Global Partners, told IANS.

Companies like Hindustan Unilever, Adani Ports & SEZ, Bharti Airtel, ITC, Hindustan Zinc, UltraTech Cement, HDFC Bank, Reliance Industries and Wipro are expected to announce their quarterly results in the coming week.

Besides Q3 results, investors will look out for upcoming macro-economic inflation data points such as the WPI (Wholesale Price Index) and Balance of Trade figures.

Market participants will also give their first reaction to the IIP (Index of Industrial Production) and CPI (Consumer Price Index) figures which were released after the market hours on Friday (Jan 12).

“Over the next week, market will react to the sharp jump in IIP for November to 8.4 per cent and CPI for December to 5.2 per cent. Restocking in the consumer non-durables space and healthy activity in the capital goods sector are responsible for the sharp increase in IIP,” Anindya Banerjee, Deputy Vice President for Currency and Interest Rates with Kotak Securities, told IANS.

In terms of investments, provisional figures from the stock exchanges showed that domestic institutional investors (DIIs) purchased stocks worth Rs 2,383.11 crore during the week, while foreign institutional investors (FIIs) sold company scrips worth Rs 965.16 crore.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors bought equities worth Rs 554.03 crore, or $88.34 million, during January 8-12.

On the currency front, the rupee weakened by 26 paise to close at 63.63 against the US dollar from its last week’s close at 63.37.

“As far as levels are concerned, we look forward to 63.25-30 as the near-term support for USD-INR and 63.90-64 as a major resistance,” Banerjee said.

As per technical readings, Nifty is expected to surge higher and breach new record highs during the upcoming week.

“Technically, with the Nifty surging higher to new record highs, the underlying intermediate uptrend remains intact,” Deepak Jasani, Head – Retail Research, HDFC Securities, told IANS.

“Further upsides are likely once the immediate resistances of 10,690 points are taken out. Weakness could emerge if the supports of 10,490 points are broken.”

Last week, “consistent investments” from domestic institutions propelled the the key equity indices — the Sensex and the Nifty50 — to close at record high levels.

Consequently, the barometer 30-scrip S&P Sensex of the Bombau Stock Exchange surged by 438.54 points or 1.28 per cent to 34,592.39 points.

Similarly, the wider Nifty50 of the National Stock Exchange made healthy gains. It rose 122.4 points or 1.16 per cent to 10,681.25 points.

(Rohit Vaid can be contacted at rohit.v@ians.in)

–IANS

rv/vm/sac

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

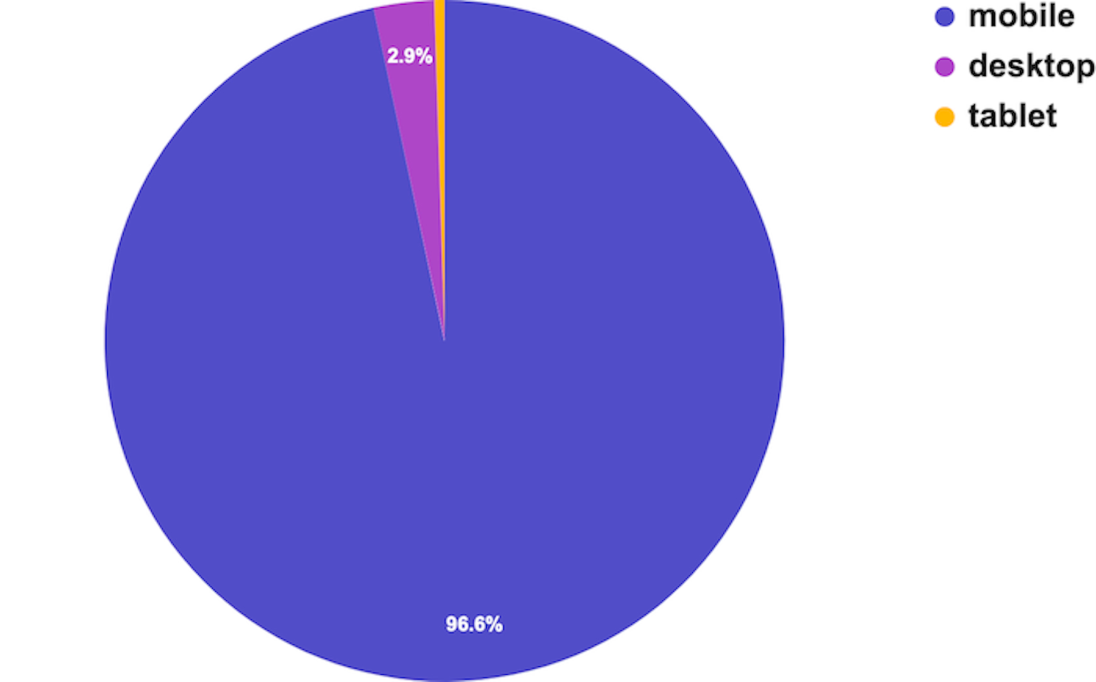

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

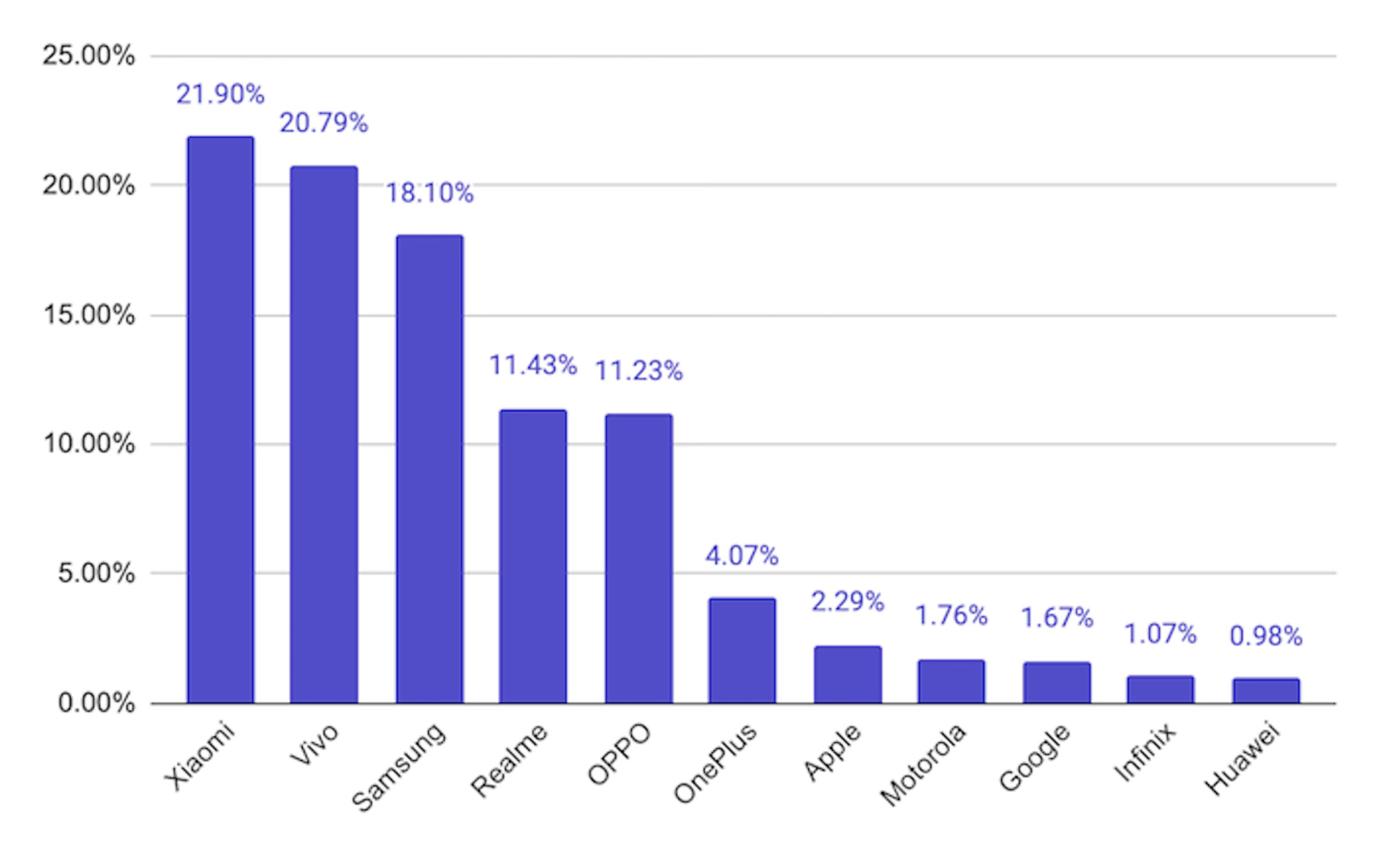

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom