Top News

India needs over $200 bn of investment in renewable infrastructure

By Vishal Gulati

Bonn, Nov 21 (IANS) India is on track to catalyse $200-300 billion of new investment in its renewable energy infrastructure in the next decade with global capital inflows playing an increasingly crucial role, a top financial analyst with a leading US-based institute foresees.

India’s decarbonisation policy is in line with global trends which, since 2011, have been seeing investments in renewable energy infrastructure running at two-three times of that for new fossil fuel capacities, Tim Buckley, Director of Energy Finance Studies Australasia with the Institute for Energy Economics and Financial Analysis (IEEFA),

said.

At present, India relies on thermal power generation for 80 per cent of its electricity, while hydro supplies a significant 10 per cent and renewables just seven per cent.

However, India has set an ambitious but achievable national target of 275 GW of renewable capacity installed by 2027.

Changes to tap renewable resources are on the way.

Indeed, the tipping point may have been 2016-17, when the net thermal capacity plummeted and renewable installs more than doubled, Buckley said in his report “Indian electricity sector transformation” made public on Tuesday.

These developments continued into 2017 with costs of both falling by an unprecedented 50 per cent and recent tenders now pricing renewables at 20 per cent below the average price on existing Indian thermal power generation.

The report examines the rapid transformation in India’s electricity market, showing how renewable energy and energy efficiency measures can help the country minimise the growth of coal-fired electric generation.

Electricity demand in India is expected to double over the coming decade, and how this electricity will be generated is important for both India and the world.

“We present an electricity sector model out to 2027 showing how India can meet almost all of its growing electricity needs via increasingly cost-competitive renewable energy resources and numerous energy efficiency measures, while at the same time keeping its coal use in check, at perhaps no more than five-10 per cent above current levels,”

Buckley told IANS in an email response.

India is the world’s second-largest producer, consumer and importer of thermal coal. It’s also the third largest electricity user in the world after China and the US.

Toeing the path of developing renewable energy infrastructure, prices of both wind and solar power have recently fallen significantly in India with record low prices seen this year.

As a result, for the first time in India, addition of new renewable generation topped that of thermal power in 2016-17.

During this period, net thermal power addition fell to just 7.7 gigawatts, well below the roughly 20 GW added annually in the prior four years, while renewable additions jumped to 15.7 GW, the report said.

India’s draft national electricity plan calls for renewable energy installs to average 21-22 GW annually going forward.

Given the rapidly improving economics of renewable, solar’s cost is down 50 per cent in just two years, for example hovering at about $0.038 per kilowatt-hour, making this an achievable target.

Some in India have been concerned about rising module prices in the near term, but IEEFA pointed to the record low $0.018 and $0.021/kWh tariffs awarded in Mexico and Chile respectively this past week.

Clearly India can look forward to further renewable energy tariff reductions medium term, the report said.

While renewables are expected to surge, IEEFA forecasts that net thermal power capacity additions are likely to remain below five GW annually in the next decade, held in check by increased retirements of highly polluting, end-of-life sub-critical coal-fired power plants.

“We expect retirements to average more than 2.5 GW annually, but with coal-fired power plant utilisation rates averaging just 56.7 per cent in 2016-17 and little prospect of this improving over the coming decade, retirements could well accelerate to four-five GW annually,” said Buckley.

These retirements are likely to be pushed forward by the reality that solar and wind already are being deployed at tariffs below those of even existing domestic thermal power generation.

India’s target to all but cease thermal coal imports by the end of this decade is now the logical economic outcome, especially since plants using expensive imported coal are increasingly the high-cost dispatch option.

As the second largest importer of thermal coal globally, this is a materially adverse development for nations exporting thermal coal.

“The challenges to integrating India’s 40 per cent renewable energy target by 2030 are real, but the momentum over the past three years, gained through government policy and economic merit, give us confidence India will stay the course,” the report said.

India is ranked 14th in the Climate Change Performance Index (CCPI) 2018 out of 56 nations and the European Union by environmental organisation Germanwatch, an improvement from its 20th position last year, for reducing greenhouse gas emissions by opting to transform its electricity sector towards green technology.

China, with its high emissions and growing energy use over the past five years, still ranks 41st, says the Germanwatch’s report released last week.

At the just-concluded UN Climate Change Conference (COP23) in Bonn, a coalition led by Canada and Britain jointly launched the Powering Past Coal Alliance with more than 20 partners, and even a US state, to move away from coal, a major source of air pollution.

A climate expert told IANS that this is a first-of-its-kind attempt to phase out the traditional coal power on such a massive scale after the 2015 Paris Climate Change Agreement that aims to keep global warming within 1.5 degrees Celsius by cutting greenhouse gases from burning fossil fuels.

(Vishal Gulati was in Bonn at the invitation of Global Editors Network

to cover the COP23. He can be contacted at vishal.g@ians.in)

–IANS

vg/vm

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

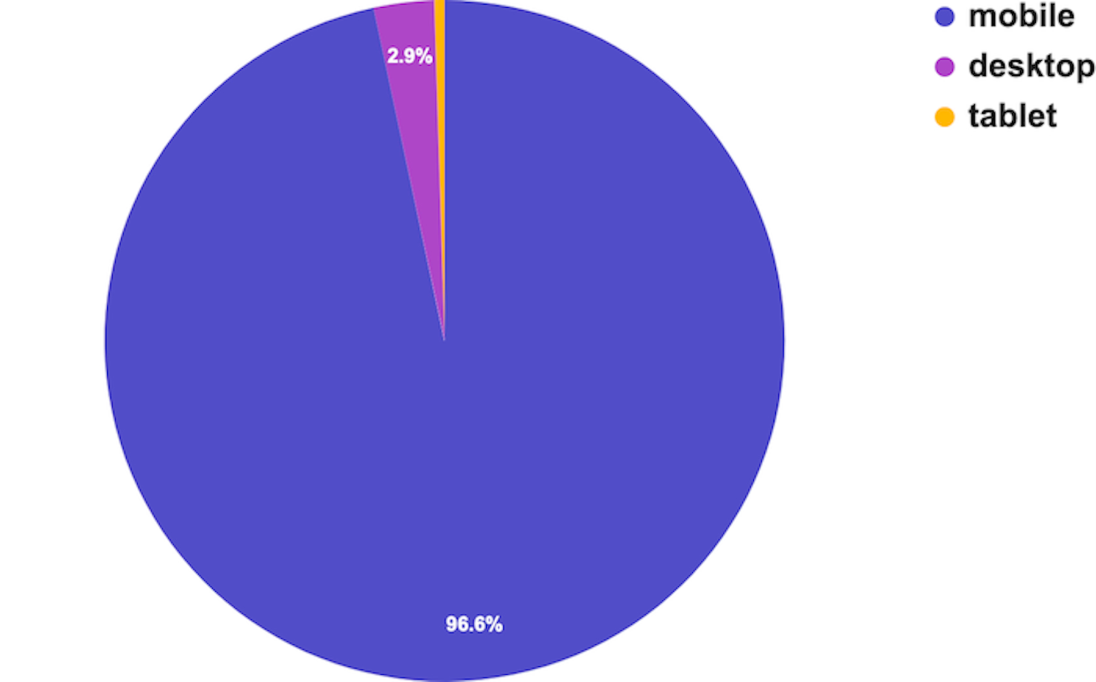

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

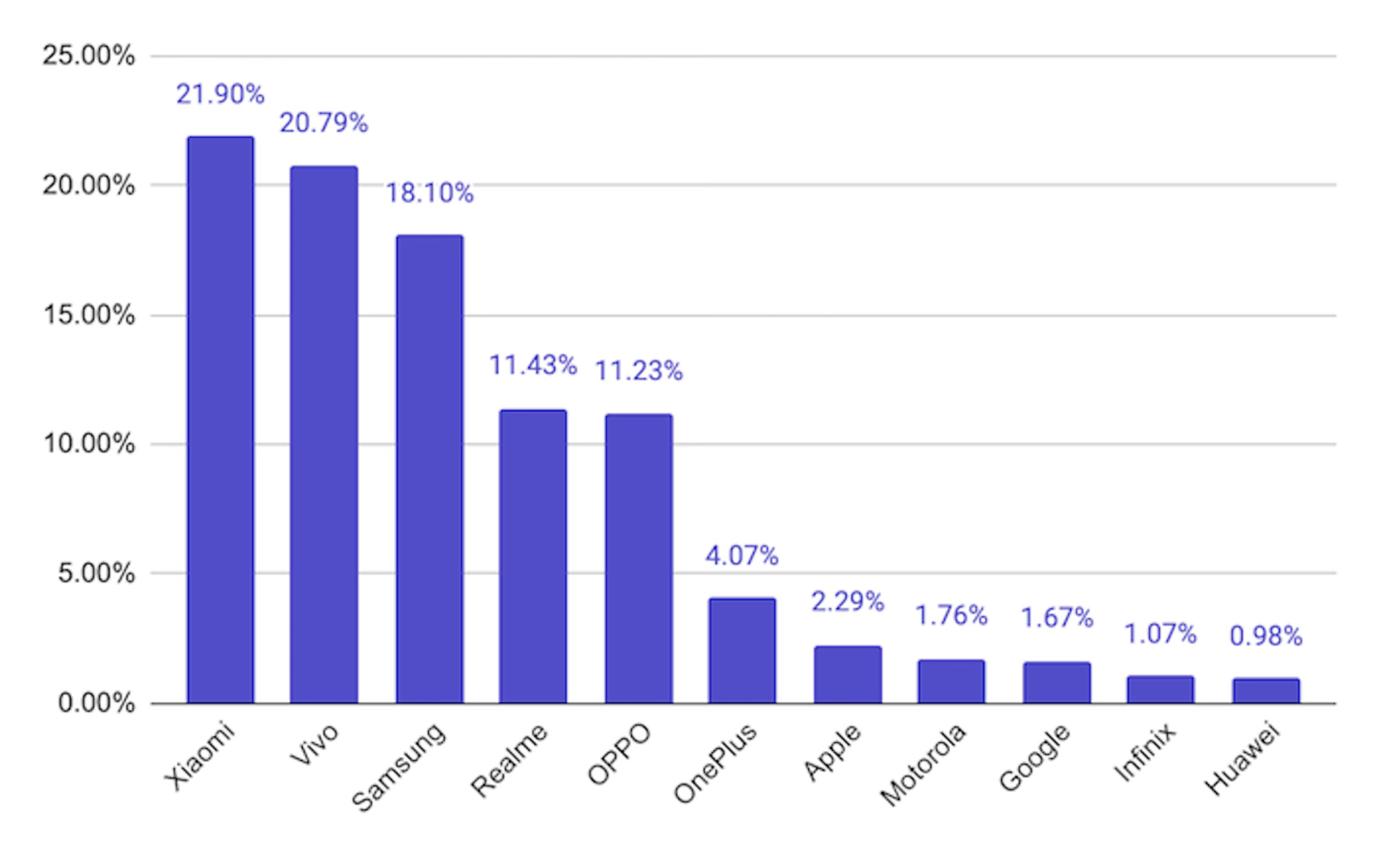

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom