Top News

RBI maintains key rates, but eases liquidity (Third Lead)

Mumbai, Oct 4 (IANS) Rising inflationary pressure and concerns over “fiscal slippage” prompted India’s central bank, the RBI, on Wednesday to maintain its key lending rates.

However, the central bank eased liquidity constraints, and also lowered the country’s growth projection due to implementation of the Goods & Services Tax and loss of consumer and business confidence.

According to the Reserve Bank of India’s fourth bi-monthly monetary policy review of 2017-18, the repurchase rate, or the short-term lending rate for commercial banks on loans taken from it, has been maintained at 6 per cent.

Consequent to the decision to maintain the repo rate, the reverse repo rate remained at 5.75 per cent.

“The decision of the MPC (Monetary Policy Committee) is consistent with a neutral stance of monetary policy in consonance with the objective of achieving the medium-term target for Consumer Price Index (CPI) inflation of 4 per cent… while supporting growth,” the fourth bi-monthly monetary policy statement said.

The decision was taken by the six-member MPC headed by RBI Governor Urjit R. Patel. Five members of the panel voted in favour of maintaining the key lending rate.

The six-member MPC is equally divided amongst government nominees and the RBI.

At its last policy review in August, the central bank had reduced its repo rate by 25 basis points (bps) to 6 per cent from 6.25 per cent.

“The MPC observed that CPI inflation has risen by around two percentage points since its last meeting… Such juxtaposition of risks to inflation needs to be carefully managed. Although the domestic food price outlook remains largely stable, generalised momentum is building in prices of items excluding food, especially emanating from crude oil. The possibility of fiscal slippages may add to this momentum in the future,” the statement said.

“The MPC also acknowledged the likelihood of the output gap widening, but requires more data to better ascertain the transient versus sustained headwinds in the recent growth prints. Accordingly, the MPC decided to keep the policy rate unchanged. The MPC also decided to keep the policy stance neutral and monitor incoming data closely. The MPC remains committed to keeping headline inflation close to 4 per cent on a durable basis.”

However, to induce liquidity into the system, the RBI reduced the Statutory Liquidity Ratio (SLR) — a reserve requirement that commercial banks must maintain — by 50 basis points to 19.5 per cent from October 15.

Further, RBI lowered the country’s growth projection for 2017-18, pegging the Gross Value Added (GVA) at 6.7 per cent.

The central bank had earlier estimated India’s GVA in 2017-18 to grow at 7.3 per cent.

Taking into account various factors during the fiscal, the RBI said: “The projection of real GVA growth for 2017-18 has been revised down to 6.7 per cent from the August 2017 projection of 7.3 per cent, with risks evenly balanced.”

The equity markets, which had already discounted any further reduction in key lending rates, made substantial gains as RBI reduced the SLR which created healthy demand for the banking stocks.

The key indices also rose on the back of positive global cues and value buying.

The wider Nifty50 of the National Stock Exchange (NSE) rose by 55.40 points, or 0.56 per cent, to 9,914.90 points.

The 30-scrip Sensitive Index (Sensex) of the BSE, which opened at 31,522.17 points, closed at 31,671.71 points — up 174.33 points, or 0.55 per cent.

The S&P BSE banking index rose by 0.17 per cent to close at 27,126.98 points.

Kotak Mahindra Bank closed higher by 2.16 per cent, followed by Yes Bank (up 1.55 per cent), State Bank of India (up 0.82 per cent), Punjab National Bank (up 0.39 per cent) and IndusInd Bank (up 0.37 per cent).

On the other hand, ICICI Bank (down 0.88 per cent), HDFC Bank (down 0.66 per cent) and Axis Bank (down 0.63 per cent) were losers on the BSE.

–IANS

rv-bc-ppg/dg

Entertainment

Casino Days Reveal Internal Data on Most Popular Smartphones

International online casino Casino Days has published a report sharing their internal data on what types and brands of devices are used to play on the platform by users from the South Asian region.

Such aggregate data analyses allow the operator to optimise their website for the brands and models of devices people are actually using.

The insights gained through the research also help Casino Days tailor their services based on the better understanding of their clients and their needs.

Desktops and Tablets Lose the Battle vs Mobile

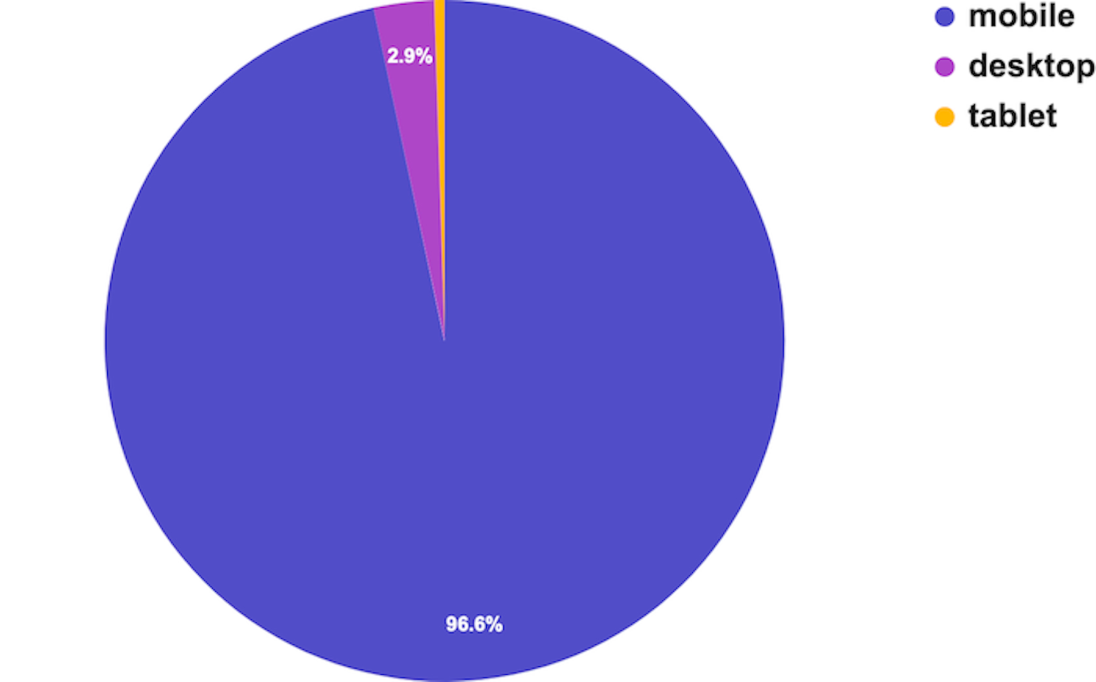

The primary data samples analysed by Casino Days reveal that mobile connections dominate the market in South Asia and are responsible for a whopping 96.6% of gaming sessions, while computers and tablets have negligible shares of 2.9% and 0.5% respectively.

The authors of the study point out that historically, playing online casino was exclusively done on computers, and attribute thе major shift to mobile that has unfolded over time to the wide spread of cheaper smartphones and mobile data plans in South Asia.

“Some of the reasons behind this massive difference in device type are affordability, technical advantages, as well as cheaper and more obtainable internet plans for mobiles than those for computers,” the researchers comment.

Xiaomi and Vivo Outperform Samsung, Apple Way Down in Rankings

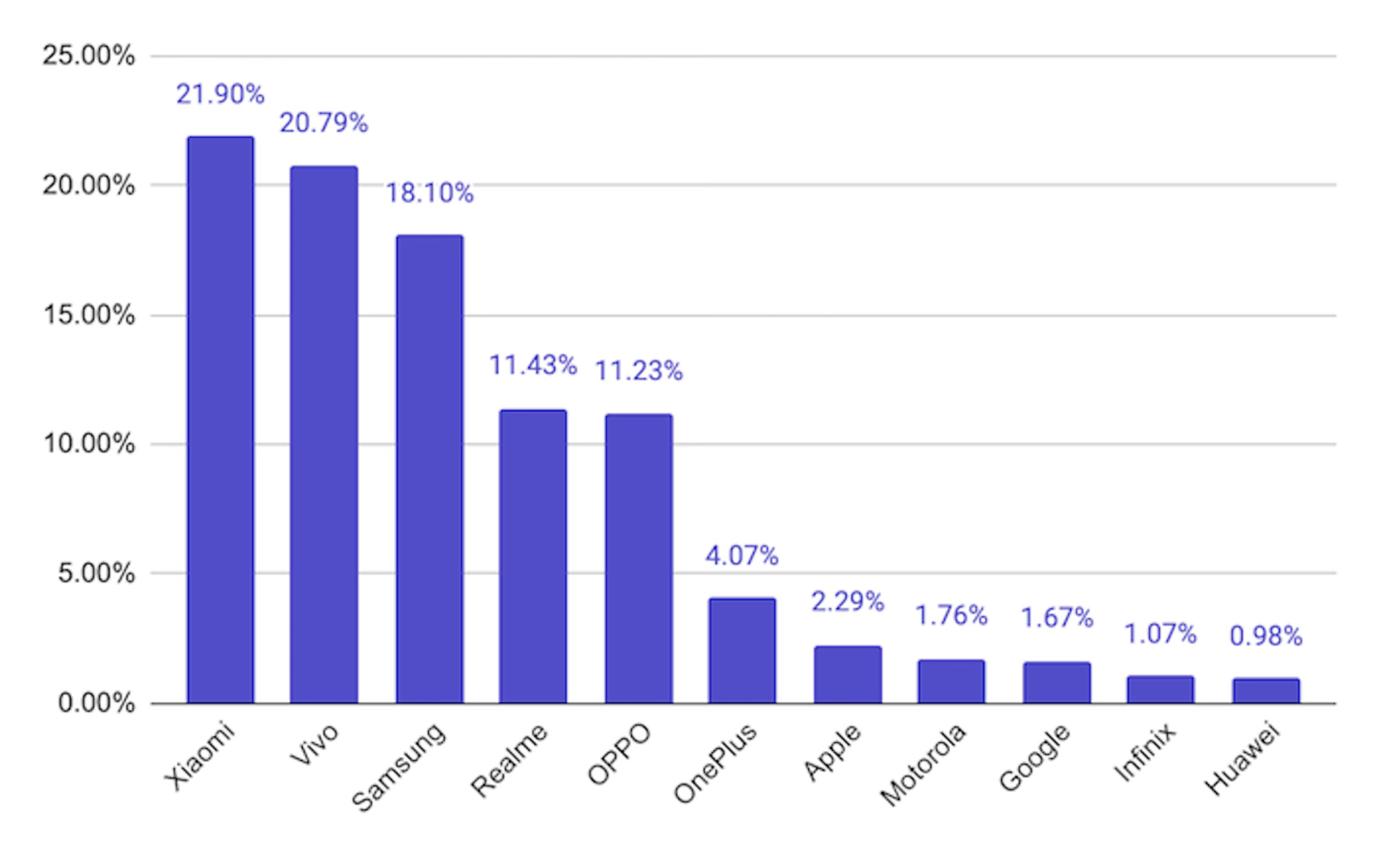

Chinese brands Xiaomi and Vivo were used by 21.9% and 20.79% of Casino Days players from South Asia respectively, and together with the positioned in third place with a 18.1% share South Korean brand Samsung dominate the market among real money gamers in the region.

Cupertino, California-based Apple is way down in seventh with a user share of just 2.29%, overshadowed by Chinese brands Realme (11.43%), OPPO (11.23%), and OnePlus (4.07%).

Huawei is at the very bottom of the chart with a tiny share just below the single percent mark, trailing behind mobile devices by Motorola, Google, and Infinix.

The data on actual phone usage provided by Casino Days, even though limited to the gaming parts of the population of South Asia, paints a different picture from global statistics on smartphone shipments by vendors.

Apple and Samsung have been sharing the worldwide lead for over a decade, while current regional leader Xiaomi secured their third position globally just a couple of years ago.

Striking Android Dominance among South Asian Real Money Gaming Communities

The shifted market share patterns of the world’s top smartphone brands in South Asia observed by the Casino Days research paper reveal a striking dominance of Android devices at the expense of iOS-powered phones.

On the global level, Android enjoys a comfortable lead with a sizable 68.79% share which grows to nearly 79% when we look at the whole continent of Asia. The data on South Asian real money gaming communities suggests that Android’s dominance grows even higher and is north of the 90% mark.

Among the major factors behind these figures, the authors of the study point to the relative affordability of and greater availability of Android devices in the region, especially when manufactured locally in countries like India and Vietnam.

“And, with influencers and tech reviews putting emphasis on Android devices, the choice of mobile phone brand and OS becomes easy; Android has a much wider range of products and caters to the Asian online casino market in ways that Apple can’t due to technical limitations,” the researchers add.

The far better integration achieved by Google Pay compared to its counterpart Apple Pay has also played a crucial role in shaping the existing smartphone market trends.

Content provided by Adverloom